- Home

- Sustainability

- Integrated Report

- Message from the President and CEO 2023

Message from the President and CEO 2023

Using “AminoScience” to accelerate our growth and progressing from structural reform to growth

After I became CEO in April last year, we launched our 100-day plan to propel the Ajinomoto Group into a regrowth stage. Our plan is to integrate the various business strengths from our focus on the function of amino acids to establish an overwhelming presence for the Group.

Taro Fujie

Director, Representative Executive Officer,

President & Chief Executive Officer

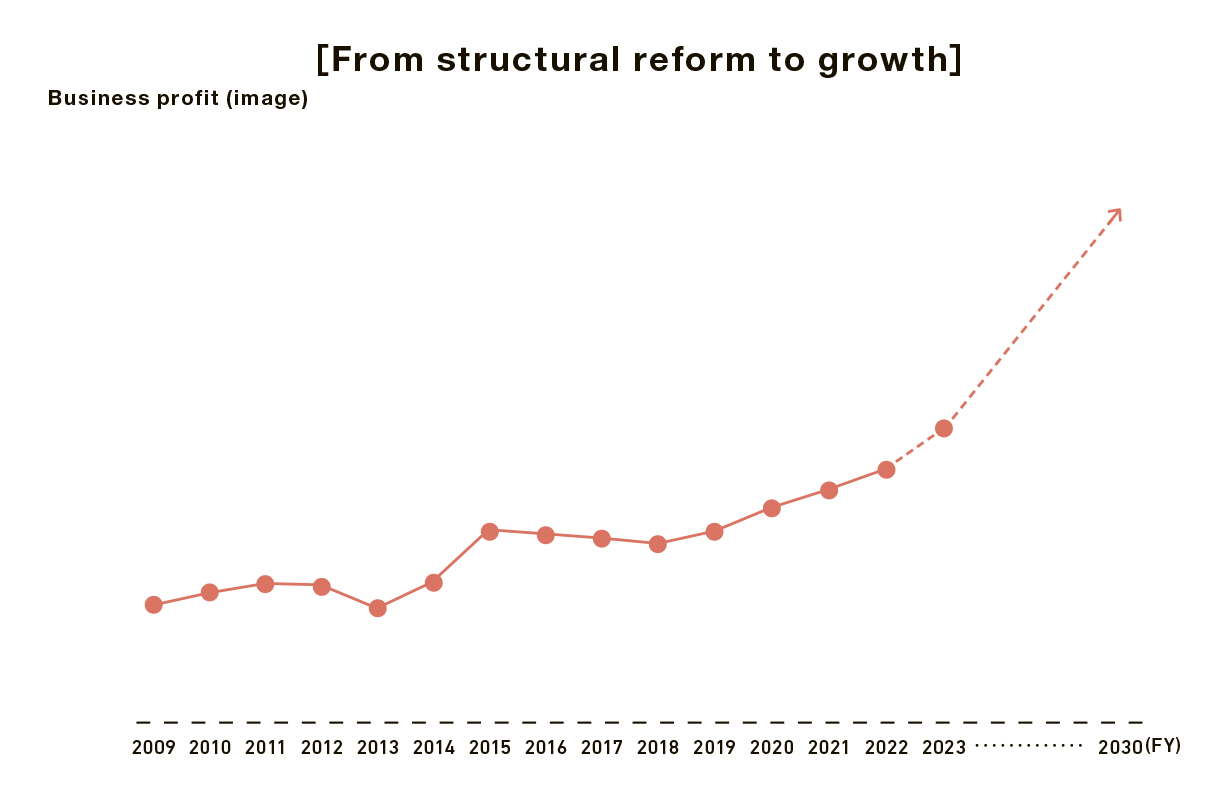

Record-high profits as we entered our new growth stage a year earlier than expected

In the year since April 2022 when I became the company CEO, we have been engaging in an all-our effort to reform our management systems. It was a tumultuous year with the COVID-19 pandemic, the conflict in Ukraine, high inflation, and sharply fluctuating foreign exchange rates. Nevertheless, we determinedly executed our 100-day plan (a detailed 100-day plan under the new execution structure) and the substantial progress we made developing the AminoScience business and reestablishing profitability for our food products business raised our sales by 18.2% year on year to ¥1,359.1 billion and business profit by 11.9% to a record-high ¥135.3 billion. The price of our stock also rose to a new high. Fiscal 2022 was the final year of Phase 1 of the 2020-2025 Medium-Term Management Plan. Although the focus of Phase 1 was structural reform, we view the results as marking the start of our regrowth stage Phase 2 one year ahead of schedule. We have also been lauded for the progress we made with our human resources, corporate brand, and other intangible assets as well as for our sustainability and digital transformation (DX) initiatives. I would like to express our sincere gratitude and appreciation to everyone’s understanding and support for the Group as we continue to fulfill our Purpose.

Not content with record profits

My role is to always be looking toward the future. A company’s current corporate value is determined by cash flow—not in the past and only to a certain extent in the short term, but primarily by expectations for cash flow in the long term. That is why I am not content with high profits or positive evaluations of the Company. I recognize that that there is a disparity between our Company and leading global companies in terms of growth potential and profitability is a major issue that we need to address. We are taking the positive approach that this means we have plenty of room to improve and grow. The Medium-Term ASV Initiatives 2030 Roadmap we announced in February 2023 set ambitious targets, including raising business profit by over 10%. All of the Group companies are committed to working together as a team to achieve the targets.

“AminoScience” added to our Purpose

The first step we took was to update our Purpose statement to “Contributing to the well-being of all human beings, our society and our planet with ‘AminoScience’.” “AminoScience” is a term that we created. We take pride in being the best in the world as an organization of “amino acids x science x business” that is thoroughly committed to the functions of amino acids and develops business by adopting a scientific approach. We are integrating the strengths of our various businesses with the aim of establishing an overwhelming presence.

Our roots and our strongest business models are our combination of amino acids, science, and business

Our roots are in the combination of amino acids, science, and business. The Ajinomoto Group originated in 1909, when our founder business person Saburosuke Suzuki II met the scientist Dr. Kikunae Ikeda, the discoverer that the source of the umami taste is the amino acid glutamic acid. I am excited that it was a Japanese scientist who discovered one of the five basic tastes. The Japan Patent Office named Dr. Ikeda as one of the Ten Japanese Great Inventors along with such illustrious figures as the discoverer of adrenaline Jokichi Takami, the creator of a human-powered loom (and founder of Toyota Industries) Sakichi Toyoda, and the discoverer of vitamin B1 Umetaro Suzuki. Dr. Ikeda and Suzuki set out with the purpose to make food delicious and healthy to help Japanese people develop the strong physiques that they observed in people of Europe and the United States. Their idea that they could make the biggest contribution by creating a successful business has been passed down through the generations and today is manifest in our ASV management of using our business to co-create social value.

Since becoming CEO, I have often talked about upscaling. For us to upscale, we need to turn our successes into business models that we can then build on to continue expanding. I believe our way of success from combining amino acids, science, and business is our strongest model and what sets the Ajinomoto Group apart from all other companies.

The essence of CEO Fujie_1

Q. What led to you joining the Ajinomoto Group?

One reason I joined the Ajinomoto Group is because it is a food company. I’ve enjoyed cooking since elementary school and have made meals for many people. Seeing people enjoying the meals and smiling always makes me feel happy too. The “essence of happiness” is such that the more happiness you give to others, the happier you feel. I still enjoy making appetizers every once in a while.

I was also excited to see that the Ajinomoto Group is more than a food company, that it is using its amino acids and fermentation (bioscience) technologies for businesses around the world. In fact, this is making me even more excited. I also felt extremely comfortable with the people I met during the interview process because everyone enjoyed engaging in dialogue and had strong character.

Making dialogue and understanding a business model and organizational strength

The announcement that we revised our Purpose statement from “Unlocking the power of amino acids to resolve the food and health issues” to “Contributing to the well-being of all human beings, our society and our planet with ‘AminoScience’.” actually led to some misunderstanding within the Group. Many people may have thought that we were planning to shift our focus completely to AminoScience business. The new statement actually just recognizes that “AminoScience” has been the foundation of all of our businesses from the beginning. In the food products business, we have been using the power of “AminoScience” for flavor, nutrition, and physiological functions as a way to differentiate our products and grow our business. In other words, the new Purpose statement merely recognizes the higher concept of “AminoScience” that is in all of our business activities. The confusion comes from the word “AminoScience” being used as both a high-level concept and the name of the business, and we are looking into changing what we call the businesses.

Understanding of the meaning of “AminoScience” has deepened considerably since we announced new Medium-Term ASV Initiatives 2030 Roadmap with the revised Purpose, which was accompanied by an unprecedented number of messages and numerous conversations between employees, myself, and management. All of us are excited about the infinite possibilities for the amino acids×science×business combination, and I believe that everyone in the food products and other businesses is feeling more motivated than ever. The reconceptualization of “AminoScience” will be a good reminder of the importance of the progressive cycle in which dialogue allows us to identify gaps in understanding and follow it up with more dialogue, mutual understanding, and deeper penetration of our Purpose, Vision, and strategies that then leads to increased engagement and powerful implementation. Altogether, this will become our foundation and enhance our organizational strength.

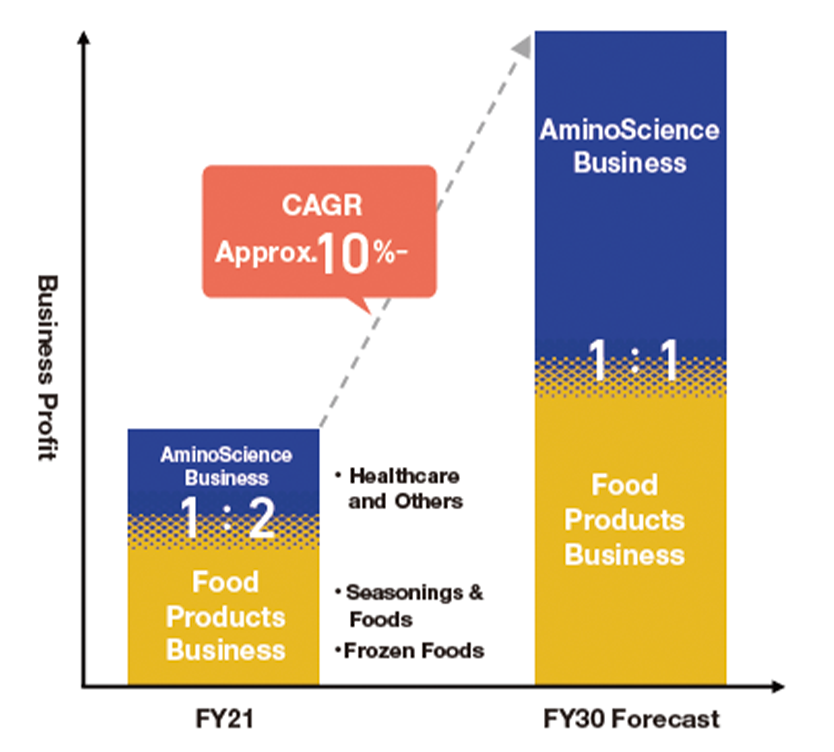

Creating a 1:1 balance of the food products and AminoScience businesses

We have set a target for 2030 of attaining an even 1:1 ratio of business profit from the food products business and the AminoScience business. It was only a few years ago that the food products business dominated our earnings and the ratio was 9:1, but the AminoScience business has been gradually building and in 2021 the ratio reached a much more balanced 2:1. An important point in attaining the 1:1 ratio we are targeting for 2030 will be to grow both businesses because our goal is to make the Ajinomoto Group an organization that is not just a food company and not just an amino acid company—we want to be a unique entity on the world stage.

In the future, we will drive our growth by increasing our businesses that combine our food products business and AminoScience business. Because our food products and AminoScience businesses had been structured vertically, last year we announced that we had appointed Mr. Yoshiteru Masai, whose background was in the AminoScience business, as the General Manager of the Food Products Division and Mr. Sumio Maeda from the food products business as the General Manager of the AminoScience Division. The positive benefits of making that switch are starting to show. For example, we had been focusing on the deliciousness of our products when we proposed new products to one of our food company clients. The company was especially receptive when we introduced a pet food product with an amino acid mix function for pet health, and told us that this is the one-of-a-kind product that we have been expecting from the Ajinomoto Group. This successful experience is now becoming a foundation that we will build on horizontally across our businesses.

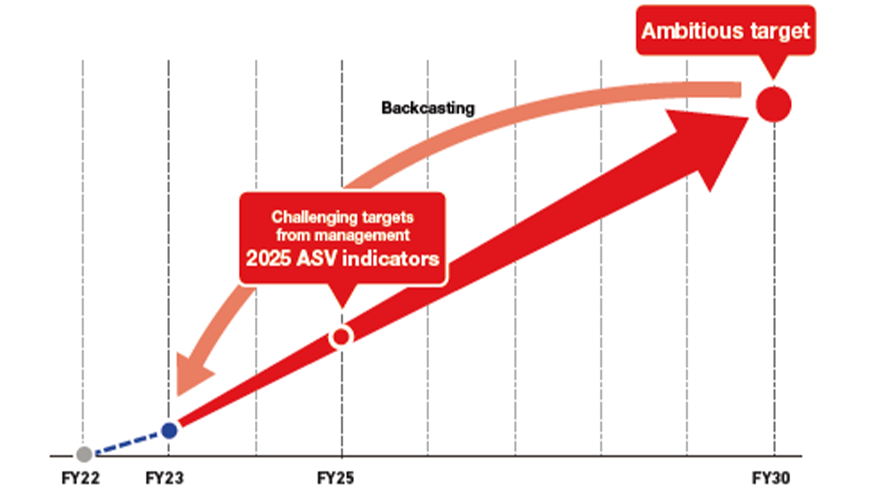

We are abandoning being bound by mediumterm planning so we can all aim to scale Mt. Everest.

As I mentioned in my message last year, we replaced our long-standing use of medium-term management plans with management that pursues ambitious targets that we set by backcasting from our long-term vision. With the rapid changes in society, this means moving past our habit of excessive planning and developing management that is constantly refining its approach to reflect the changing circumstances. In the future, I think we will look back at 2023 as a turning point for the Ajinomoto Group.

The mountain we aim to climb is not Mt. Fuji, it is Mt. Everest. With a certain amount of training, a person can climb Mt. Fuji on their own. Scaling Mt. Everest, however, requires careful planning for what kind of team you will assemble, which route to take, and what equipment will be needed to reach the summit. There is an African proverb that says, “If you want to go fast, go alone; and if you want to go far, go together.” I will choose to go together and aim to climb high like Mt. Everest.

We are aiming to achieve CAGR of 10% annual growth in business profit, raise ROIC to 17% and ROE to 20%, and triple our EPS.

At the end of February this year, we released ASV indicators for economic value, social value, and intangible assets for 2030. We have set ambitious financial targets that include CAGR of 10% in business profit, raising ROIC to 17% and ROE to 20%, and tripling earnings per share (EPS). Climbing Mt. Everest is a challenge of a whole new dimension, but if we can refine our strengths, change our corporate culture, make full use of our intangible assets, and unleash the power of “AminoScience,” I believe we can make it to the top. For more information, please see our February 28, 2023, press release about our Medium-Term ASV Initiatives 2030 Roadmap.

I want us to growth in three ways by transforming management, updating our business portfolio, and by improving our intangible assets and the ROIC tree.

We transformed management toward our vision for 2030.

The first point of the 2030 Roadmap is transforming our management approach to “purpose-driven management by medium-term ASV initiatives.” The roadmap represents our commitment to advancing these initiatives by providing and seeking to fulfill earnings forecasts for each fiscal year, transforming our business model, and earnestly engaging Ajinomoto Group Creating Shared Value (ASV) to continue advancing toward our ASV indicator targets. To reach our Group vision for 2030, management will backcast from our targets and create a roadmap of ambitious indicators to guide us in fulfilling our vision.

The ASV indicators show not only economic value but also social value that lead to economic value. The high targets will challenge all of us to continue doing our best to achieve growth, which will grow into a strong momentum that will continuously and dramatically boost our corporate value. To ensure we are making progress, we will set rolling monthly forecasts to measure what is working and what is not so we can take swift action when needed.

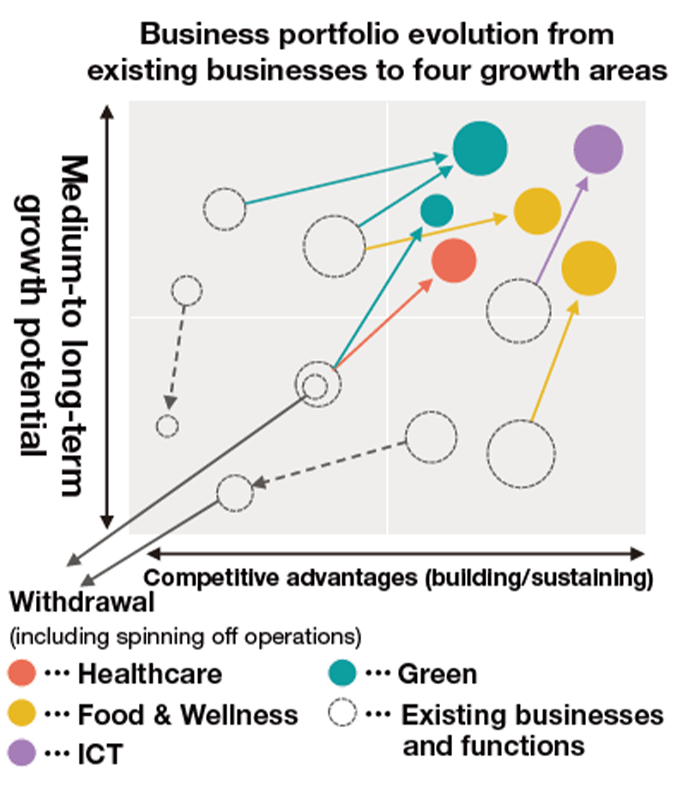

We have fully revised our business portfolio management.

We have revised our business portfolio management by recentering it on growth potential and efficiency, specifically by strongly emphasizing maintaining ROIC higher than WACC to improve efficiency and by prioritizing being asset light by reducing our asset holdings and operating on a lean financial structure. We will be more conscious about developing our growth potential, while ROIC higher than WACC will be a prerequisite. Our new business portfolio management will be based on a concept with medium- and long-term growth potential on the vertical axis and building competitive advantages and sustainability on the horizontal axis. While concentrating management resources on growth areas and shifting to a highly profitable business structure, we will continuously evolve our business portfolio management while sowing seeds for the future and flexibly withdrawing from unprofitable areas.

Our present organizational structure is centered on products and services, but we will advance growth strategies for each value we provide, create new links that reach beyond the boundaries of our existing businesses and organizations, and fully activate both our tangible and intangible assets. We took a significant step in this direction in April 2023 by creating the new Marketing Design Center, Procurement Strategy Department, and Innovation Strategy Team.

The essence of CEO Fujie_2

Q. What has been your experience with the Company?

I’ve had a number of experiences with the Company that have left an impression. When I was part of the labor union, I created relationships of trust through cross-organizational contacts with human resources from various departments who are working on front lines. That experience was invaluable because it helped me understand that human resources assets are the center of an organization. I was also a manager at subsidiaries in the Philippines, China, and other countries that were struggling quite badly, but the experiences were extremely valuable and have become part of the model for how I approach my work.

From these experiences, I learned the importance of agile execution, communicating bad news, and maintaining a culture of thorough dialogue and problem-solving rather than precise planning in times of rapid change. I also learn as the value of making the decision to stop one activity so you can focus on doing the one you really want to do.

We are increasing investment in intangible assets, which are pre-financial assets, and incorporating them into the ROIC tree.

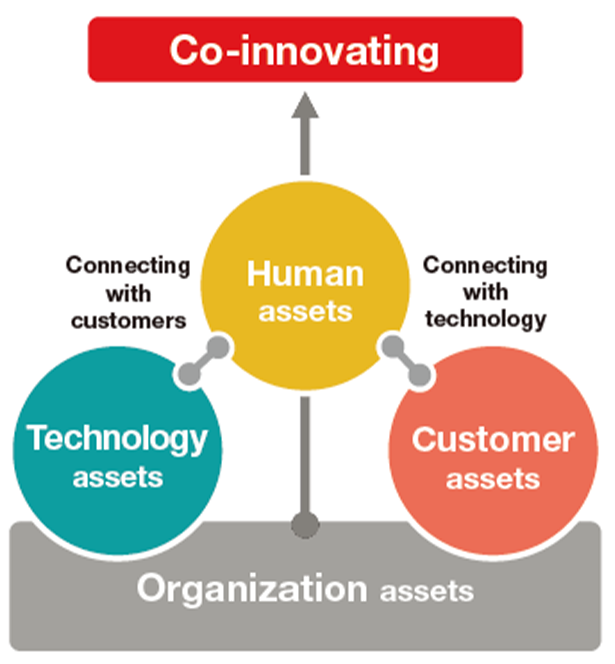

The last point of the 2030 Roadmap is investing in intangible assets. The image below shows the connection between the four intangible assets –human, technology, customer, and organization. Our human resources are unique in that we have a purpose, are deeply connected to our customers and consumers, and use our world-leading “AminoScience” technology to co-create innovation. We value “purpose x passion x operational excellence” because we believe that human resources are essential intangible assets, and because we believe that the enthusiasm that employees have for their purpose is a company’s driving force.

Our human resources are a source of pride for us. In addition to the world’s top 1,700 researchers in “AminoScience,” the reason the Group is a global food corporation with brands and products commanding top share in markets around the world is because we have people applying our Deliciousness Technology to the dietary habits of each country, people exercising our brand power and marketing methods utilizing DX, and people creating business by skillfully communicating the importance of uncompromising nutrition to customers ranging from large supermarkets to small stores.

What I would like to emphasize is that we believe that intangible assets are not non-financial assets, but prefinancial assets that will lead to financial growth in the future. The reason we invest more in intangible assets than tangible asset is that we believe intangible assets are certain to produce financial value in the future. Since our tangible assets won’t be increasing, ROIC will move upward while both the numerator and denominator become smaller. Based on that, we have started trying to find a way to put investment in intangible assets into the ROIC tree. We have only started to examine how to do that, but we believe that when we can visualize intangible assets like the correlation between employee engagement and business performance and corporate brand value assessment, we will be better able to use the intangible assets for value creation.

The essence of CEO Fujie_3

Q. I heard that you were passionate about windsurfing when you were a student.

In the CEO message, I quoted the story of Mt. Everest, but in fact, I myself was more of a sea person rather than a mountain person. When I was a student, I was so passionate about windsurfing that I went to Lake Biwa in Japan, the practice place, rather than the campus. Windsurfing is a sport where you compete to see where the wind is blowing. Even in a headwind, you can use lift to zigzag forward. How can we read the direction of the wind and increase the speed of the ship? And how do we conquer the tough race? As we head into 2030, the wind will change rapidly and there will be headwinds, so I would like to read the changes, speed up my growth, and use my experience to survive the tough competition.

We will make materiality a management axis.

Before putting together the Medium-Term ASV Initiatives 2030 Roadmap, the Sustainability Advisory Council reorganized the key management issues that form our corporate materiality on a strategic framework from a long-term perspective. The Council, which is made up of people representing various stakeholders, engaged in dialogue with managers and directors for two years. The Ajinomoto Group does not use the standard list or matrix of important matters of materiality, we have our own way of illustrating them that shows their relationships and cycles. Our objective is to “hone our co-creation capabilities, realize well-being from the consumer’s perspective, and return the value we create with our business activities.”

It is clear that the global environment will collapse if mankind persists in its pursuit of material wealth. This can be avoided by changing the indicator of wealth to well-being, the state of being healthy and happy. To do this, we will need scientific innovation. I believe the Ajinomoto Group has huge potential to develop in this area. That is what we had in mind when we created our materiality. However, people inside and outside the Company have told us that it is a little difficult to understand, so we are talking to various people to find ways to make it simpler and to provide specific examples that will help make it easier to grasp.

In June 2023, we invited Professor Scott Davis of Rikkyo University, who was the chair of the Sustainability Advisory Council when we were formulating the new materiality framework, to be an outside director of the Company. We believe his presence will ensure that our materiality initiatives are not just some pie in the sky dream and that we have the structure to execute appropriate measures. I believe that sustainability initiatives help discover new business opportunities and reduce cost of capital.

We will continuously strengthen shareholder returns to encourage investors to hold shares long term.

We will actively distribute the gains from our business growth to shareholders who understand and support our operations. Top priority will be given to investment for growth, such as necessary equipment, intangible assets, and M&A, but when we have surplus operating cash flow, we will actively implement share buybacks as investments that exceed WACC. In addition, to ensure investors will feel secure in holding our shares and receiving dividends for the long term, we have a progressive dividend policy of not reducing dividend payments and ensuring we maintain or increase dividend payments. We also eliminate potential fluctuations due to irregular gains or losses, by determining the amount of dividend distribution from our business profits based on normalized EPS. Since we expanded our employee stock ownership program from management to all Group employees, the percentage of employees who own stock in the Group has grown from approximately 30% to 70%. In this way, our ASV management and 2030 Roadmap are adding to the economic value of our employees.

Dialogue, dialogue, dialogue.

As I mentioned earlier, we are engaging in active dialogue to ensure that the 2030 Roadmap does not become just a pie in the sky idea. Since we announced the 2030 Roadmap, the management members and myself have been talking to people in person, sending video messages, and participating in numerous small group conversations. Talking directly with people is important not only because it deepens their understanding, but also because it allows me to discover new elements. Most Ajinomoto Group employees are also eager to engage in dialogue, and I believe that will expand the circle of understanding, increase each person’s sense of ownership, and ultimately accelerate the roadmap’s implementation. We are also emphasizing dialogue with shareholders, investors, and other stakeholders. We have started to be extremely proactive about sending out messages from management, sharing the content of our dialogue discussions, and providing information about Ajinomoto Group human resources and other intangible assets. I encourage you to view our website.

- CEO Fujie’s message at FY2023 Ajinomoto Group Management Policy Briefing

- Dialogue with Group Employees (Japanese)

- Ajinomoto Group Event for Customers, Announcement of Employee ASV Initiatives (Home use) (Japanese)

In fiscal 2023, we will aim to boost sales and profits as well as address issues.

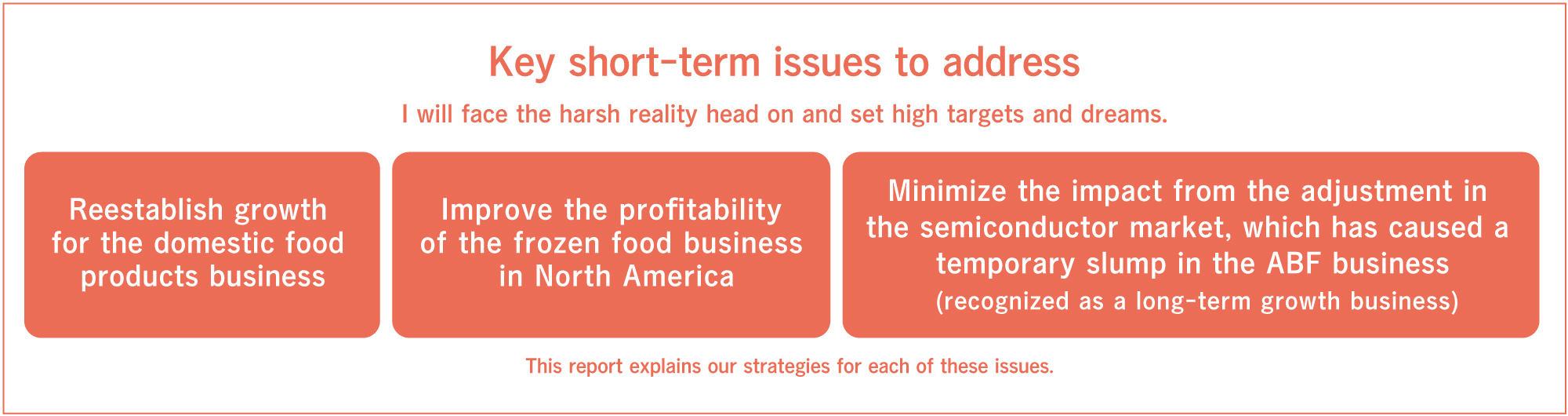

The long-term and short-term are connected, so we will not neglect our short-term performance just because our management is focused on the long term. In fiscal 2023, we will have various short-term and medium-term issues that we will need to address, including reestablishing growth for the domestic food products business, improving the profitability of the frozen food business in North America, and responding to the changes in the semiconductor market. As we address those areas, we also will be applying Speed Up x Scale Up with the aim of raising fiscal 2023 sales by approximately 8.8% year on year, business profit by roughly 11%, EPS by approximately ¥6.2, ROE to 12.4%, and increasing the dividend payout.

We will also be addressing many other issues, including improving employee engagement scores, which are already high but not at our target level, fostering a culture of selfdriven work, improving our perception among young workers as a having a growth environment, and raising the participation of women in our workforce to the global standard. Based on my experience, I believe that creating visualization will contribute greatly to finding solutions for all of these matters. I am looking forward to openly discussing these issues in dialogue with people both inside and outside the Company.

We believe that good health provides well-being and will deliver the “essence of happiness” around the world.

In addition to the economic value indicators, we are also actively working to fulfill social value indicators set in the Medium-Term ASV Initiatives 2030 Roadmap, which are to help extend the healthy life expectancy of 1 billion people and reduce our environmental impact by 50%. We have also added “AminoScience” and the word “well-being” to our Purpose. To me, well-being means being happy and healthy, which is exactly what our founding aspiration “Eat Well, Live Well.”

As stated in our updated Purpose, the Ajinomoto Group is using “AminoScience” to create a source of happiness for human beings, society, and the planet—the essence of happiness. We are already the world leader in the combined field of amino acids, science, and business, and we are integrating the strengths of our businesses to make our position and presence unassailable. We hope investors and stakeholders will share our excitement and Purpose so we can climb the Mt. Everest of creating long-term value together. I sincerely look forward to opportunities to engage in dialogue and hear your comments and opinions.

What I want to communicate

- We will pursue ASV in earnest through “AminoScience,” adopt purpose-driven management by medium-term ASV initiatives, and improve our ability to execute.

- We will use “AminoScience” to contribute to the well-being of human beings, our society, and our planet.

- We will enhance corporate value by steadily generating cash flow, improving growth rates, and lowering the cost of capital.

- We will achieve organic growth and shift growth to four areas.

- We visualize and strengthen the value of intangible assets, which are the driving force for enhancing our corporate value.

- We will clarify the path to creating social vaiue and economic value and improve sustainability.

- We will apply “purpose x passion x operational excellence” and Speed Up x Scale Up.