Message from the President and CEO 2019

Resolutely restructuring to realize sustainable growth

As the digital revolution accelerates, it is changing the Ajinomoto Group’s business environment in significant ways. The sharp increase in data traffic is changing people’s values. Consumer purchasing habits are also changing, influenced by e-commerce and the sharing economy. As a result, corporate business models are forced to transform. In B2C commerce, for example, the Group’s sales channels are changing greatly due to the reorganization and merging of logistics and retail businesses under the need of digital shift. In Japan and other technologically advanced countries, mass-market brand competition is heating up, as evidenced by declining sales of products having little competitive advantage. The Group faces an unforgiving competitive environment in which survival depends on building high barriers to entry through strong technological advantage and sophisticated branding.

In this context, the Group’s vision is to become a Genuine Global Specialty Company growing sustainably though ASV — The Ajinomoto Group Creating Shared Value. On the way to this goal, the Group is pursuing its FY2017-2019 (for FY2020) Medium-Term Management Plan (“FY17-19 MTP”) centered on the evolution of ASV, with a target of becoming a Global Top 10 Class Food Company by FY2020. Progress is being made on schedule both in strengthening the business foundation and in achieving non-financial targets associated with core businesses.

Reaching financial targets is, in contrast, difficult. Flagging sales in some weaker food businesses outweighed favorable performance from stronger food brands and the AminoScience business — which is increasingly focused on its core competencies. As a result, the Group is in a difficult situation to achieve its FY2020 integrated target of US$1,500 million in corporate brand value.

In view of the above, the Group aims to get our business back on a path toward a sustainable growth by resolutely restructuring in accordance with the next MTP to be announced in February 2020. This means we will increase the contribution to sales of the Group’s core businesses by focusing growth investment on categories which can aim at the global top three position.

Investment in non-core businesses, on the other hand, will be minimized. To bolster support for the Group’s growth, corporate functions and Group companies that handle other aspects of the Group’s business will increasingly partner with outside enterprises to facilitate their digital transformation. During FY2019 the Group will, therefore, prepare for 2020’s launch of full-fledged restructuring while beginning some tasks ahead of schedule.

This integrated report explains the Group’s management environment and growth strategy. It covers the issues faced by Group companies and measures to be taken in response. In addition, it also charts the Group’s path to sustainable growth through ASV.

Above all, we value your understanding and continued support.

July 2019

Takaaki Nishii

Representative Director,

President & Chief Executive Officer

Interview with the President and CEO

Q1 How do you rate the progress of the FY17-19 MTP at this point?

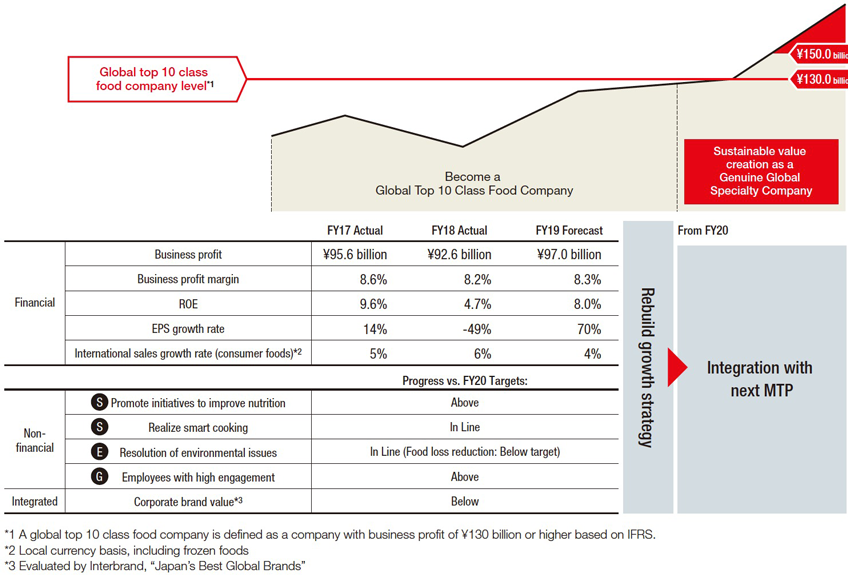

Reduced profitability accompanying a slowdown in food business growth has made FY2020 financial targets difficult to achieve.

Toward the Group’s goal of becoming a Genuine Global Specialty Company, the FY17-19 MTP set a target of entering the top tier of global food companies within FY2020. This calls for the following:

Elements needed to become a Global Top 10 Class Food Company

- Establish business categories that are positioned within the top three globally as core businesses

- Develop businesses on a global scale

- Generate business profit of 130 billion yen or more

- Achieve a business profit margin of 10% or higher

- Realize ROE of 10% or higher

- Develop initiatives on ESG targets that meet international standards such as the United Nations’ Sustainable Development Goals (SDGs)

The FY17-19 MTP has focused on aggressive growth investment and business foundation reinforcement to achieve this goal. However, in FY2018, which is the Plan’s second year, significant issues unfortunately remained on the financial side of the equation. The main reason for this is the sluggishness of the food business. Intensified competition seriously reduced both revenue and profit of Japan Food Products’ frozen food business and coffee business. Moreover, business profit of the North American frozen food business declined due to production and distribution cost increases. These factors resulted in a year-on-year consolidated sales increase of 1% and a year-on-year consolidated business profit decrease of 3% for the Group as a whole.

Over the medium term, as the digital revolution advances, there is also the emergence of slowing growth in the food business due to market fragmentation and intensifying competition, and increased assets due to M&A and other prior investment in recent years. The decline in asset efficiency is one of the financial structural issues. Given that it will take several years to address these issues, it has become difficult to achieve the financial targets and integrated target set forth in the FY17-19 MTP.

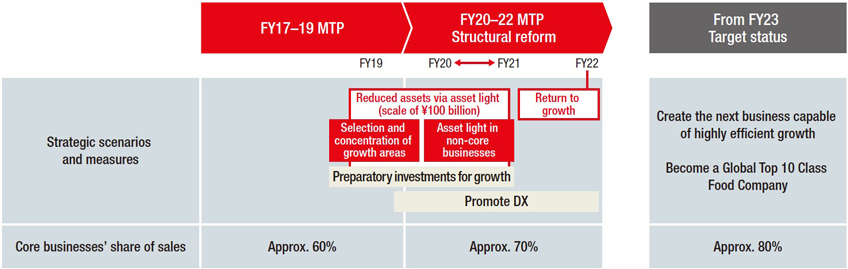

For the Group’s next MTP which launches in FY2020, we will reformulate our growth strategy in order to assure attainment of financial targets and achieve a return to sustainable growth. Using FY2019 as a preparatory year, we will promote selection of priority businesses in which to concentrate management resources, while also proceeding with establishment of a framework of structural reform.

Roadmap to a Genuine Global Specialty Company

Q2 Please describe the concept behind the next MTP and its main policy points.

The Group is moving to asset-light management and implementing DX* to reformulate its growth strategy.

* Digital transformation

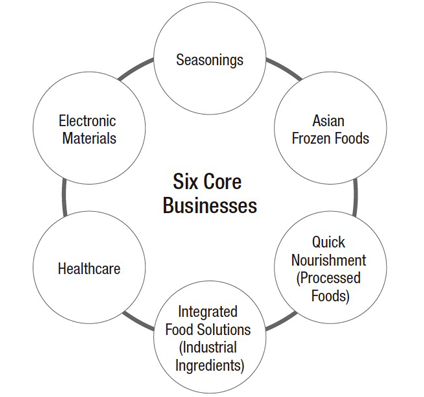

The Group’s next MTP calls for further concentration of management resources in selected core businesses. To prioritize selections for growth investment, we reevaluated each business in terms of growth potential, asset efficiency (ROA), brand strength, and technological superiority in the face of changes in the business environment. As a result, we have selected six core businesses comprising seasonings, Asian frozen foods, quick nourishment (processed foods), integrated food solutions (ingredients for food processing), healthcare, and electronic materials, at this point. Concentrating investment in these core businesses is, I believe, the surest strategy for realizing the growth rates and efficiencies expected from stakeholders over the medium to long term.

The above six core businesses currently account for about 60% of consolidated sales. Within the period of the next MTP the Group is seeking to raise this figure to about 70% while building the foundation of a business structure capable of sustaining an overall top-line growth rate of 4% or higher.

In response to accelerating market fragmentation reflecting consumer diversity, the Group must intensify data-driven marketing and speed up the product development cycle to further boost its growth rate and capital efficiency. Therefore, in the next MTP, we will strongly promote DX as the principal way to enhance market competitiveness and efficiency of the Group, focusing on core businesses.

Delivering products and services that customers need in a timely manner begins with market segmentation derived from Big Data analysis using outside alliance. It continues with steps to bring customers closer to Group brands. This calls for digital technologies such as social media and e-commerce sites, extending to cross-border e-commerce. Also essential is a dynamic and speedy development system extending from R&D to finished products or services. This is behind the Group’s R&D reorganization in April 2019. Under the new structure, we will flexibly allocate human resources and equipment according to the development theme, and promote commercialization from consumer/customer viewpoints.

Revamping business processes through DX is one imperative. Others are supply chain reengineering for agility, and small-lot-high-mix product line automation. Through these changes, the Group aims not only to develop a large number of small-sized businesses but also to discover products and services with high growth potential from it and to develop it into a more profitable middle-sized business. This is the new-business creation model that the Group is intent on realizing.

In the next MTP, we will accelerate growth by focusing on core businesses and DX in this way, while limiting investment to the bare minimum for maintaining non-core businesses. Options will include downscaling or outright sale of the non-core assets. In addition, we will promote resource allocation, such as the repatriation of the Group’s cash and deposits, and the sale of policy shareholdings. The promotion of these measures for asset-light management is another major pillar of the next MTP. As for asset-light management, we are already examining specific measures. Some of these measures will be taken in FY2019, ahead of plan, and we plan to divest assets by approximately 100 billion yen over the three-year period until FY2021.

Roadmap for the next MTP

Q3 How does going asset-light tie into future business growth? Won’t this affect shareholder returns?

While proceeding with asset-light management, the Group will prioritize investment in growth. This strategy will foster business growth and bring consistency to shareholder returns.

The Group’s promotion of asset-light management does not only mean asset divestiture for improving capital efficiency. The Group’s earning power in terms of operating cash flows is expected to be a conservatively estimated 350 billion yen over three years, after implementing asset-light measures. By focusing on capital investment in core businesses, we will control the total amount of capital investment including the new DX investment at approximately 220 billion yen. In regard to shareholder returns, we aim for a total return ratio of 50% or higher, and single-year dividend payout ratio of over 30%. In line with the policy, we will achieve a 3-year sum-total payout of more than 100 billion yen. Discontinuous growth through M&A is planned with borrowing kept at a net D/E ratio of around 50%. The asset-light management will generate cash to supplement this, giving the Group additional flexibility to maintain a healthy balance sheet.

Q4 What are your views on the macro environment and latent risk?

The Group seeks to minimize risk through quick decision making and execution of contingency plans.

Macro risk triggers are numerous. They include exchange rate or interest rate volatility, revision of the tax system in countries in which we operate, and deterioration of fiscal balances in emerging countries. Short-term assessment of risk rooted in macro environmental changes is not always perfect and risk-triggering events can occur at any time. I see the severity of the risk environment trending upward due to market entry of competitors including cross-sector rivals, as well as rising costs.

In response, we will continue to strengthen monitoring of the macro environment, analyze and respond to various risk factors in a timely manner, and diversify risk appropriately. Measures will also be taken to quicken decision making and contingency plan execution. By focusing on our unique specialties and accelerating productivity improvement incorporating DX, the Group seeks to minimize management and business risks.

Q5 How does the growth strategy mesh with non-financial targets and materiality?

Financial targets are inseparable from non-financial targets. The Group pursues ASV, creating shared value to fulfill its social mission.

The Group’s social mission is to contribute to the resolution of three social issues through its business activities: health and well-being, food resources, and global sustainability. Issued every three years, the Group’s MTP lays out the path to sustainable growth and increased medium- to long-term corporate value, realized by simultaneously creating social value and economic value, as a corporation, through business activities. We are working to share this value creation initiative named ASV with society as well as within the Group.

We constantly update our non-financial targets pertaining to ESG issues and materiality. Existing ESG targets cover reduction of greenhouse gases and food loss. A newly added target last year is to achieve zero plastic waste by FY2030 through 3Rs (Reduce, Reuse, Recycle) practices.

In addition to incorporating non-financial targets, I believe that it is an important responsibility as a global food company to achieve SDGs and lead the way to a sustainable society. The Consumer Goods Forum, CGF, carries out a variety of activities in the area of sustainability. As a CGF board member representing the Ajinomoto Group, I am involved in the dissemination and development of the initiative.

Social issues require selection and approaches suited to the particular region. Japan, for example, has many social issues, but one of the most critical is the decline in the working population, correlating to the nation’s declining birthrate and aging population. Labor shortages have become commonplace in the food and retail industries, especially in production, distribution, and sales.

In response to these structural changes in society, companies are striving to raise operational efficiency and productivity. The situation also calls for industry-wide initiatives. In April 2019, five of Japan’s food companies started joint product delivery. The launch of this joint venture addresses the increasingly serious situation facing the logistics industry, notably the persistent shortage of truck drivers and environmental issues. By restructuring food company logistics for efficiency and sustainability, the new company aims to reduce environmental impact through streamlined delivery and make more effective use of management assets such as human resources and equipment.

Q6 What are your thoughts on staffing for growth strategy or enhancing ASV?

We develop management talent that shares the Group’s core competencies and values and shows leadership potential.

First, I will talk about managerial talent. The key mission of top management is to meet and exceed the expectations of our stakeholders. To complicate matters, expectations vary with stakeholder class: investors, shareholders, customers, employees, local residents, and so on. Therefore, managerial talent is required to have a sense of the balance and good communication skills to listen to the voices of a wide range of stakeholders and to achieve satisfaction of the greatest common factor for diverse demands.

The important values for all of the Group’s human resources, not just managerial, are creativity and pioneering spirit which are also part of the Ajinomoto Group Way.

The Group has two core competencies. One is leading-edge bioscience and fine chemical technologies derived from research, development, and production of amino acids. The other is marketing and sales capabilities to evolve these technologies as a business adapted to customers and local communities worldwide.

Leveraging these two core competencies since its establishment, the Group has created businesses with new social value, such as seasonings and processed foods that meet the specific food demands of various countries and regions, and functional materials such as amino acid derived high-performance cell culture media essential for R&D of regenerative medicine.

The most important resource of these core competencies is none other than employees who embody creativity and pioneering spirit. The managerial talents of the Group must lead by keeping these Group values and core competencies firmly in mind while tailoring solutions to customers’ changing needs and circumstances.

In addition, the Group is actively promoting DX, which calls for talent with higher literacy in AI, IoT, robotics and other leading-edge technologies. This is not the same thing as having specialized technical knowledge and programming skills. What we need are people who can architect how to leverage technology to, for example, improve the Group’s productivity and enhance corporate brand value. To supervise such initiatives the Group has newly established the post of the Chief Digital Officer (CDO). Under the leadership of the CDO, the next step is to secure and train sufficient talent to plan strategic courses of action and carry them out.

Q7 What concluding words do you have for stakeholders?

The Group is making thorough preparations for launch of the next MTP, which sets the course for a return to sustainable growth.

The Ajinomoto Group is navigating toward sustainable growth by further accelerating and evolving ASV, the creation of shared value. In this way the Group is maturing into a Genuine Global Specialty Company, a presence indispensable to people everywhere. To pave the way for realization of this vision, the FY20-22 MTP calls for drastic business structural reforms. Toward successful completion of strategic measures and to achieve financial and non-financial targets, FY2019 will be a year of thorough preparation.

Details of the measures are scheduled to be announced in February 2020. This Integrated Report 2019 nevertheless describes the Plan in broad strokes. It is my hope that this report will also convey the resolute spirit driving the Group’s efforts to return to growth at the earliest possible date.