Message from the President and CEO 2020

Contributing to wellness through daily foods during this worldwide crisis

Evolving ASV management with a strong sense of urgency

On behalf of the Ajinomoto Group, allow me to first express our utmost sympathies to those affected by COVID-19 and deepest condolences to those who have passed away as a result. We would also like to extend our appreciation to the frontline healthcare workers around the world helping to treat and stop the spread of the virus.

COVID-19 will have negative impacts on the Ajinomoto Group’s earnings for fiscal 2020, but we will aspire toward a v-shaped recovery in fiscal 2021 after implementing various measures to mitigate these impacts.

The pandemic will not get in the way of structural reform efforts under our medium-term management plan. Aimed at achieving our vision for 2030 to become a “solution-providing group of companies for food and health issues,” we promise to contribute to the fight against COVID-19 through our healthcare business and improving people’s diets, a strength of our company since its founding.

Where we stand today

The Ajinomoto Group finds itself at a turning point

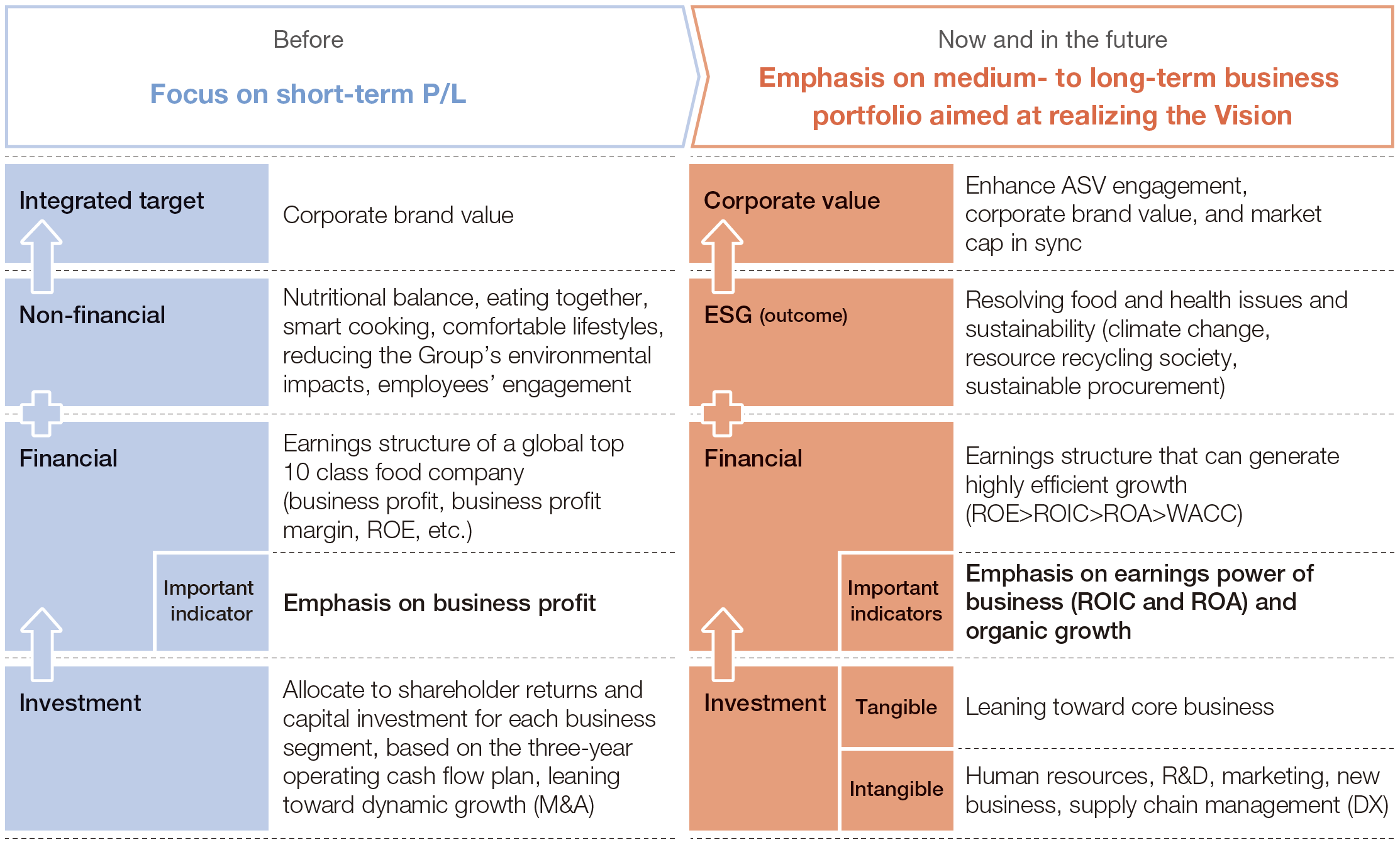

Since before the pandemic, I have felt a strong sense of urgency about the Ajinomoto Group’s current situation and future. Over the past two decades, our profits have tripled, from around 33.0 billion yen in fiscal 1999 to 99.2 billion yen in fiscal 2019. By evolving ASV (the Ajinomoto Group Creating Shared Value), which balances social value and economic value, I’m convinced that we can create greater value and contribute to the Sustainable Development Goals (SDGs) at a higher level. As was revealed when the previous midium-term management plan (MTP) was not achieved, however, we must face the risks of not being able to realize sustainable growth without using our intangible assets. During the process of formulating our new MTP, we reaffirmed the expectations placed in us through engagement with many investors. For this reason, we strongly determined that we must improve capital efficiency and return to organic growth. Put simply, we find ourselves at a turning point. At this important juncture, it is my role as President and CEO to use the correct roadmap (MTP) and compass (KPI) in determining the right path, evolving ASV management, and enhancing corporate value.

Evolve ASV management

KPI no longer based on scale

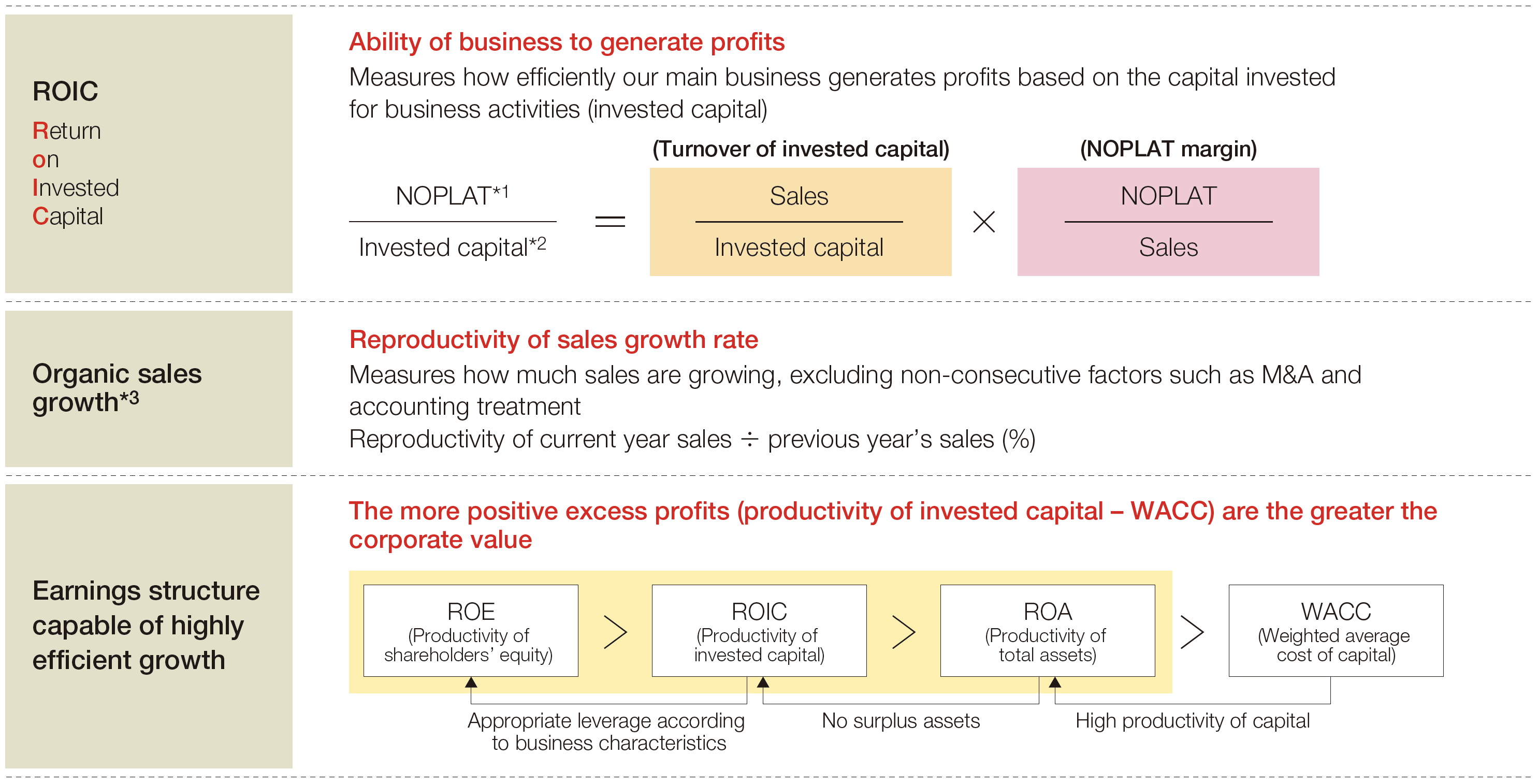

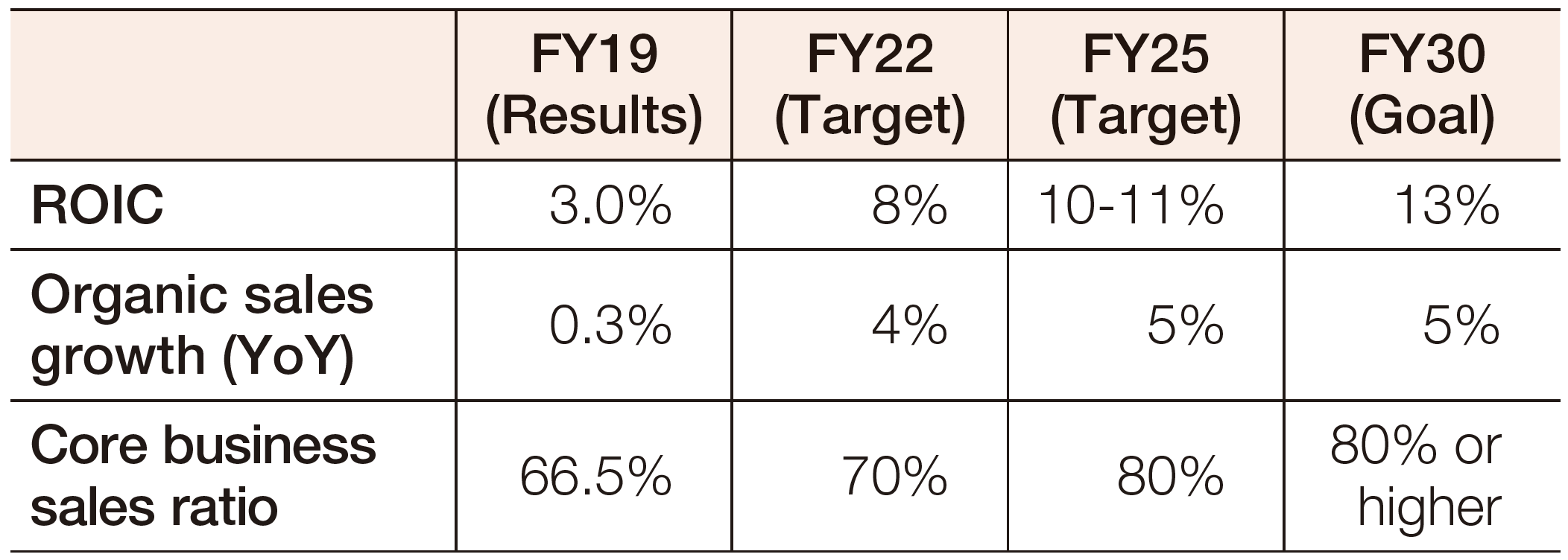

In our MTP drawn up in February 2020, we announced five financial and non-financial priority key performance indicators (KPIs): return on invested capital (ROIC), organic sales growth, percentage of sales from core businesses, employee engagement score and unit price growth. Few publicly traded companies in Japan above a certain size threshold have disclosed targets in a medium-term plan covering ROIC and weighted average cost of capital (WACC) for their core businesses without disclosing size targets. Analysts and investors wanted to know about conventional targets such as sales and business profit, while employees also seemed puzzled. To be clear, it’s not that we don’t disclose these; rather, we simply stopped setting KPI related to scale. This is because a company always pursuing scale runs the risk of becoming a conglomerate that loses direction, producing businesses that are uncompetitive or that don’t generate economic value. The reason for my sense of urgency is because our pursuit of scale in the previous MTP was a factor behind our underperformance. Unfortunately, this tendency toward KPI of scale was an integral part of our corporate culture fostered over a long period of time. Therefore, I strongly resolved that our corporate culture must be changed in order to shift to a profit policy that emphasizes ROIC over capital cost.

We reaffirmed that our competitive advantages serve as key growth drivers

When formulating the MTP, we closely examined past MTPs and took stock of our achievements and our shortcomings, including falling short of our targets despite moving closer to our vision of becoming a Genuine Global Specialty Company. Above all, it’s clear that only business units with our competitive advantages made progress by proposing unique and innovative solutions to customer issues.

While our basic and flavor seasonings have achieved the biggest market share in the world, their growth slowed during the previous MTP. We saw sales growth for our menu-specific seasonings and personal foods, and enjoyed success with frozen Asian foods and health foods, including foods with functional claims, that meet demands for health and wellness. We had success without delay in growing the market for amino acids and specialty chemicals, where health consciousness and plant-based ingredients as well as fermentation methods are linked. Although small in scale now, over the next decade I have high hopes for advanced contract development for oligonucleotides in pharmaceuticals, cell culture medium for regenerative medicine, and our proprietary AminoIndex®.

Our determination for a unified approach with strong business entities

At the same time, we also found underperforming businesses in spite of aggressive structural reform and businesses with flat or slightly negative growth over the long term despite contributing to overall business profit. From around 2018, we discovered that the relatively small-scale specialty businesses and products we had developed and marketed were losing out to competition in local markets who sharpened management resources focused on a limited number of products. Competition has lessened the effect of investment in the development and marketing of our mainstay products of basic and flavor seasonings, which is a major reason why the previous MTP didn’t go as planned toward the back half. We saw some results from our shift to specialty from bulk in the 2000s, but we also experienced the side effects above.

When I was a student, I enjoyed Japanese archery. There is a story about how Mori Motonari, a 16th century Japanese feudal lord, teaches his children that “one arrow alone is weak, but three together are strong.” We shouldn’t compete with partial optimization in individual specialty segments; rather, we must unite all these segments in total optimization following the same direction of Food and Wellness. This will transform the Ajinomoto Group into a stronger business entity, and by sharpening our management resources, we can commit the money needed for R&D and marketing in Food and Wellness. Therefore, we will hone our operations using the measuring sticks of ROIC and medium-term growth potential.

Three commitments

Vision for 2030

Our promise to become a “solution-providing group of companies for food and health issues”

The Ajinomoto Group promises that it will become a “solution-providing group of companies for food and health issues” as its vision for 2030. As part of this promise, we will focus corporate activities on improving people’s lifestyles related to food and wellness. This commitment has only grown stronger after witnessing the many people around the world who have been infected or died from COVID-19. Today, our consumer foods reach around 700 million consumers around the world. Our goal for 2030 is to help one billion people extend healthy life expectancy by promoting health and improving dietary habits through our products. I joined the company drawn to the potential offered by biotechnology and amino acids, and I’ve spent nearly 40 years passionately tackling the challenge of contributing to society by unlocking the power of amino acids.

Our commitment toward contributing to healthy body functions and a low-sodium diet through daily dietary habits

Among food and health issues, we will concentrate on excess salt intake and age-related functional decline. According to the World Health Organization (WHO), 20% of the world’s population suffers from high blood pressure, which is believed to be the underlying cause in 13% of all deaths. In addition, 20% of seniors around the world do not have sufficient nutritional intake, including proteins, which causes loss of muscle mass and declining cognitive functions. These are important issues from the perspective of living longer, healthier lives. The main power of amino acids can be found in the flavoring function of using umami to create delicious lower-salt foods and the nutritional and physiological functions of maintain and improve body functions.

Our research shows that some amino acids strengthen the body’s immunity. The Ajinomoto Group is the world leader in umami-based seasonings used in daily cooking, but until now we have not appealed these functions in markets outside of Japan. Helping resolve food and health issues with the power of amino acids represents our strength in giving back to society and an opportunity to recapture organic growth.

Promoting an ecosystem of local cooperation that successfully reduced salt intake

We will popularize food with high health value by expanding the Iwate Prefecture Salt Reduction Project that we first launched in 2014. Iwate Prefecture had the stigma of having the highest salt intake in Japan, but through an ecosystem built by Ajinomoto Co., Inc., local governments, retailers, and the media, we were able to significantly reduce people’s salt intake all the way to a level near the national average. Using low-sodium products and low-sodium menu options, we helped improve eating habits, while achieving sales growth by increasing the unit price of reduced-salt products (20% higher than normal products). This initiative involving various stakeholders that generated benefits for each aligns with the idea of stakeholder capitalism advocated at the World Economic Forum in Davos this past January. While this initiative was just recently rolled out in Japan, we will now begin to expand it to other countries. In the main countries where we operate, such as Thailand and Brazil, forecasts indicate the market for high income and upper middle income households is set to grow. This market segment spends between 1.5 and 2 times more on maintaining health than the middle income group. For this reason, we are looking to step up development and sales of products with health value and restore sales growth by unit price growth.

Burying the gap between 80% and 55%

Human resources are the key to ASV management. In the engagement survey conducted in 2019 for all of our 35,000 employees, 80% of the respondents answered that they sympathize with the concept of ASV and feel a sense of engagement. This is a high level compared to similar surveys conducted by various multinational corporations. At the same time, we have also become aware of an important issue. That is, only 55% responded, “I am able to explain using my own words that I am implementing ASV.” I believe the reason why employees have not been able to take ownership of ASV is because they do not feel the value contribution. The fact that employees cannot see how much customers are satisfied with our high-quality products outside of price, given intense price competition with other products on store shelves, or in other words, the fact they cannot feel a keen sense of how customers are benefiting, is causing employees to lack a sense of clarity.

My own personal experience with value creation

I have a rather memorable anecdote to share. This happened between 2004 and 2009 when I was in charge of consumer frozen foods, which had suffered sluggish business performance. There was excessive competition in supermarkets, with 40 to 50% discounts commonplace. We faced a situation where the market was growing, but there was no profit to be made. We narrowed our focus to a competitive product that accounted for 70% of sales, fundamentally reviewing ingredients, making in-depth quality improvements, and introducing new manufacturing technologies, aiming to increase the price by 20%. At the time, Japan was in the midst of more than a decade of deflation. Initially, nearly every employee was opposed to these moves, but as a result this product became popular, with consumers providing rave reviews of its delicious taste and ease of cooking. We were able to build relationships with retailers, wholesalers, and ingredient suppliers to share in the benefits of higher prices. Several years later profits had tripled, and all members involved in the business felt a keen sense of ASV management.

The reason why we have added employee engagement score and unit price growth to priority KPI of the MTP is to execute and monitor companywide the cycle of value creation I experienced during my time in the frozen foods business. Over the next several years, we will generate the same change by increasing added health value, including salt reduction, and accelerate ASV engagement of employees. Once talented employees embrace ASV as one’s own initiative, the Ajinomoto Group will be ready for the next stage.

Strategy and KPI

Aiming for ROIC of 10 to 11% driven business portfolio repositioning

Over the medium-term, from the standpoint of sustainable business structure, we will aim for ROIC of 13%, with the target to achieve this figure by fiscal 2030. Fiscal 2020 to fiscal 2022 is positioned as a structural reform phase, during which time we will reduce or exit non-core businesses at the current point in time, promote cost reductions by streamlining operations, and restore ROIC to the industry standard of 8%. Fiscal 2023 to fiscal 2025 is considered the regrowth phase, where we will increase ROIC to 10 to 11% by improving profitability driven by core businesses and implementing additional asset light measures, to create the foundation for structural targets set for fiscal 2030.

Earnings structure capable of highly efficient growth

- Net operating profit less adjusted taxes

- Equity attributable to owners of the parent + Interest-bearing debt

- Sales growth excluding effects of changes in exchange rate and accounting treatment, and non-consecutive growth such as M&A and business sale

Our approach to selecting business based on ROIC>WACC and growth potential

In reorganizing our business portfolio, we will position Sauce & Seasonings, Quick Nourishment, Frozen Foods, Solution & Ingredients (seasonings for restaurants and food processing manufacturers), Healthcare, and Electronic Materials as core businesses, using ROIC in excess of the cost of capital and growth potential as benchmarks. Since WACC varies by business, we will establish whether the ROIC of each business exceeds each WACC as a benchmark rather than ROIC itself. As for non-core businesses, we will transfer assets or exit or sell them by fiscal 2022. Businesses with issues in terms of growth or efficiency will be carefully scrutinized by fiscal 2022, and dealt with by fiscal 2025 based on the results.

Growth will be achieved with health value proposals and increasing demand in emerging markets

We will aim for an organic sales growth rate of 5% per annum. Our organic growth rate in fiscal 2019 was 0.3%. Core businesses alone continue to see growth of above 4%. By increasing the core business sales ratio to 70% and 80% during fiscal 2020 to fiscal 2022 and fiscal 2023 to fiscal 2025, respectively, we believe we can lift the overall growth rate by between 0.7% and 1.2%. Furthermore, we will aim for overall growth of 1.3% to 1.8% through unit price growth by appealing health value in core businesses. In fiscal 2025, we will achieve 5% sales growth on top of the new business model by resolving personal health issues directly linked to consumers. In the sense of a foundation for stable growth, it will be important to reinforce the earnings foundation by adding value to existing products and expanding channels.

In the major countries where the Ajinomoto Group operates, estimates suggest the urban consumer population will increase by 120 million people in 2030 compared to 2015. Accordingly, we will make efforts to capture opportunities from rising incomes per household.

Priority KPI

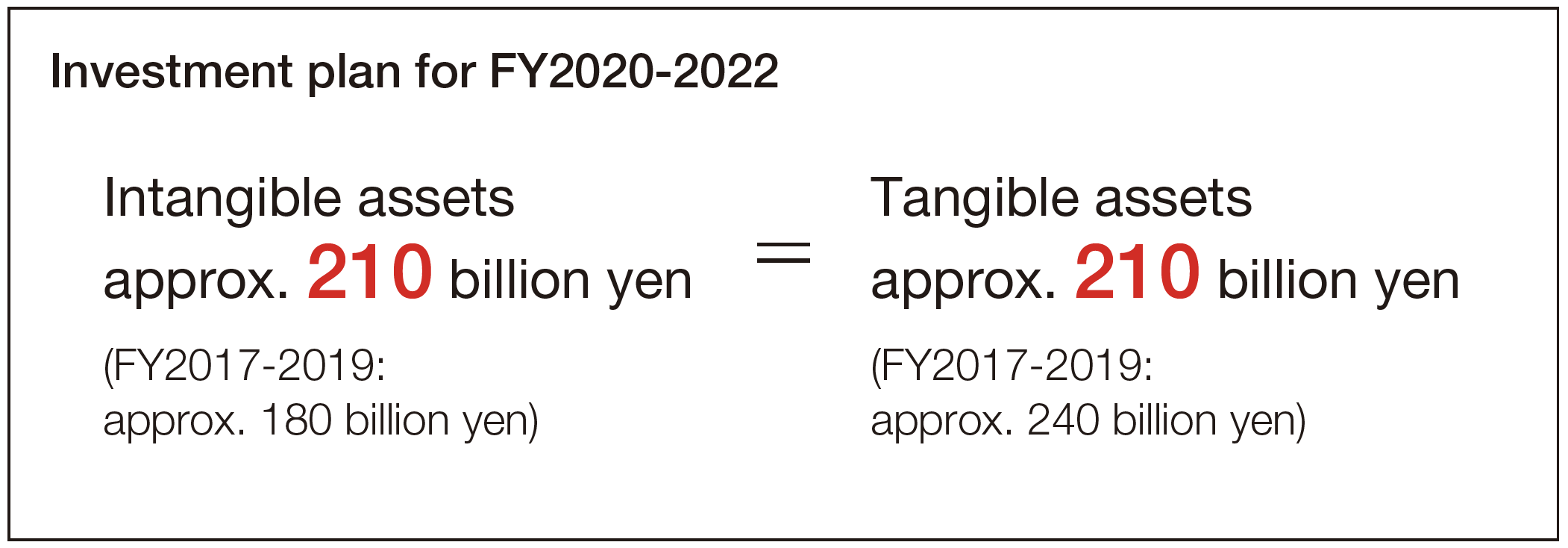

Strengthening investment in intangible assets and core businesses

Between fiscal 2020 and fiscal 2025, we will increase investment in core businesses. In addition to committing 80% of R&D, marketing and capital investment to core businesses, we will spend 26 billion yen between fiscal 2020 and fiscal 2022 on streamlining operations using digital transformation (DX), building new business models, and human resources development. The source of our competitiveness is not facilities, but rather the invisible assets of talent, technology and brand power. During the MTP, we will strengthen investment in so-called invisible assets, committing around 210 billion yen to tangible assets, and equally around 210 billion yen to intangible assets recorded in expenses for accounting purposes, such as R&D, marketing, and DX. Furthermore, we will invest in our people, which will increase the size of intangible assets more than tangible.

Key to Sustainable Growth

Attractive companies are able to attract talent

To realize our new vision, we will increase investment in talent to transform into a highly productive, issue-solving organization, increasing such spending by around 2.5 times compared to the previous MTP. We will promote diversity and inclusion in order to accelerate innovation. By 2030, we will increase the ratio of female directors and line managers to 30%. In addition, we will upgrade our work-style innovation, pursued ahead of other companies, and seek to improve our responsiveness to environmental changes.

When I was president of our subsidiary in Brazil, I was surprised at the high diversity and productivity there, and as a result, I was determined to achieve the same here in Japan. Companies with a high level of diversity and inclusion are able to share details about the purpose of work, which reduces waste. Since becoming President and CEO, I have begun efforts to reduce annual work hours per employee, increase diversity, and promote work-style innovation. Average annual work hours have already been reduced from a little less than 2,000 hours to around 1,800 hours today.

We have implemented measures ahead of peers, such as shortening the end of the work day to 4:30 pm, which is 30 minutes earlier than other Japanese companies and enabled our employees at offices and plants to work from home. In recognition of this, we received the Excellence Award at the Minister of Health, Labour and Welfare Awards for Companies Promoting Telework. These measures have resulted in improved productivity and helped us to smoothly transition to working from home during the current health emergency. Furthermore, we have seen results in acquiring talent.

Evolving ASV management aimed at achieving the SDGs

The SDGs advocated by the United Nations comprise 17 goals and 169 targets for the world to achieve sustainable development by 2030. The Ajinomoto Group is focusing in particular on addressing issues concerning health and the environment. Since our founding, we have consistently worked on resolving social issues.

In 1899, when Dr. Kikunae Ikeda studied abroad in Germany, he was surprised at the physique and nutritional status of German people at the time, which developed into a strong desire to improve the nutrition of Japanese people. Saburosuke Suzuki II, who shared this desire, launched the business in 1909 with the release of the world’s first umami seasoning called AJI-NO-MOTO®. The roots of the Ajinomoto Group can be found in our founding aspiration of “Eat Well, Live Well.” ASV management is a form of management that aspires to create both social and economic value. As a multinational corporation, and as a company deeply involved in food, we are committed to contributing to the achievement of the SDGs.

As for environmental issues, we will work toward reducing greenhouse gas emissions by 50% by fiscal 2030 and mitigating economic risks determined using scenario analysis following the TCFD recommendations by 8 to 10 billion yen, as key measures. At the same time, we will work alongside stakeholders to reduce the impacts of other important issues concerning water risk, plastic waste, food loss and waste, and sustainable procurement.

Long-standing incorrect perceptions of MSG are improving

Earlier, I spoke about my sense of urgency, but there are also bright spots. One is the improving perception of monosodium glutamate (MSG), which was an area of concern for a long time given our MSG business.

We have seen positive effects from our awarenessraising activities launched in full-scale from 2018. In a survey in the United States, more than 60% of people, mainly dieticians, had a positive view of MSG, and there is a growing move to adopt MSG in menu items by major restaurant chains and plant-based meat substitutes. In Japan, following public communications activities to eliminate misleading statements such as “additive free” and “does not contain additives,” sales of AJI-NO-MOTO® for homeuse were up year over year for the first time in a decade.

Promoting “transformation” under a new management system

Given the impacts of COVID-19 and forex volatility, at the end of the first quarter, we are forecasting a 3% decline in sales and 9% drop in business profit for fiscal 2020. As a corporate executive, I know I shouldn’t use “if and when” statements, but without the impacts of COVID-19 and forex volatility, the plan is for a 5% increase in sales and a 7% increase in business profit. As a corporate executive, I’m particular about the numbers, and implementing various measures, I am committed to a recovery in fiscal 2021 and beyond by keeping negative impacts to a minimum.

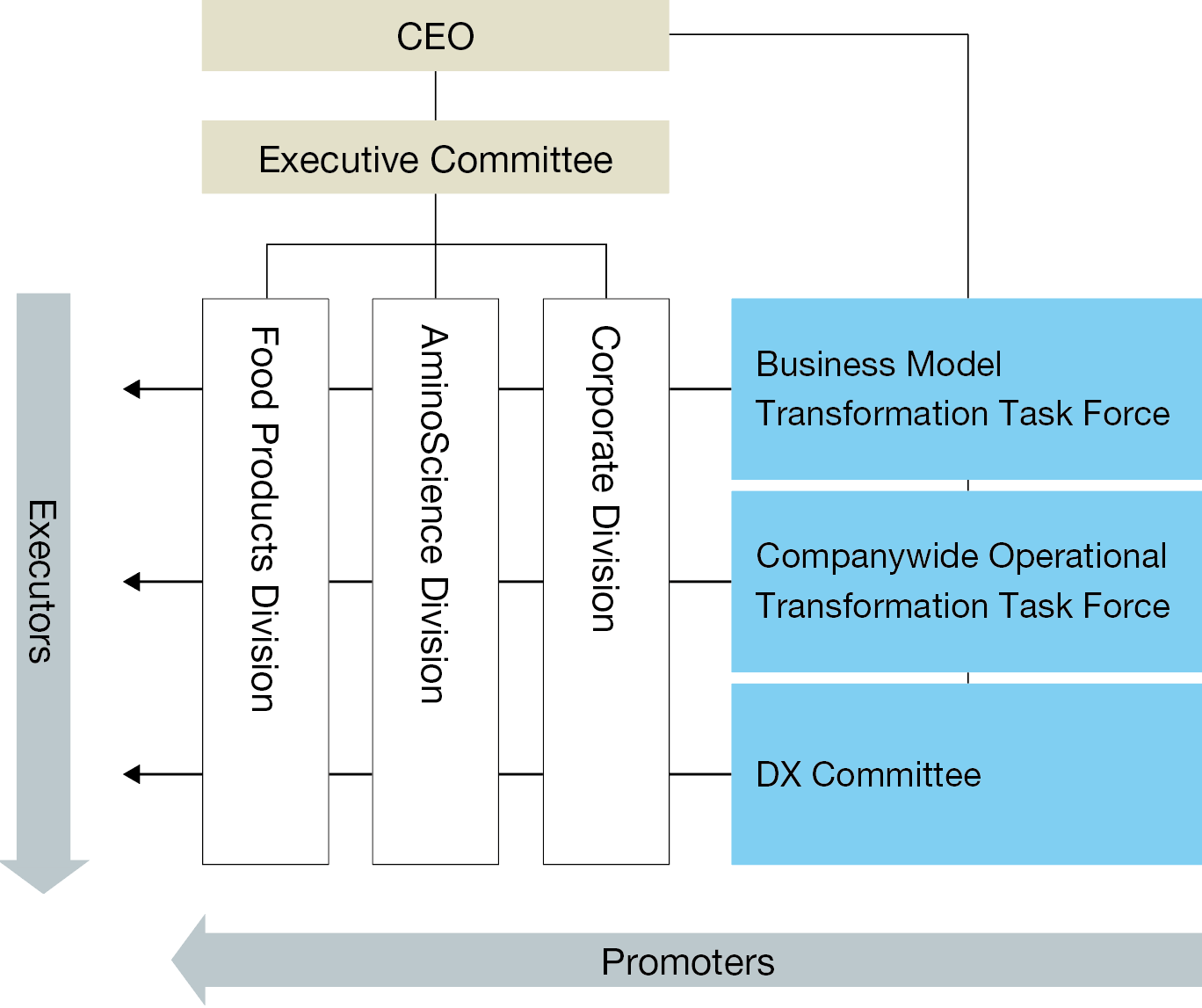

In April 2020, we launched the Business Model Transformation Task Force and Companywide Operational Transformation Task Force, both under my direct supervision, to ensure steady execution of the MTP. Moreover, we established the new positions of Chief Innovation Officer (CIO) and Chief Transformation Officer (CXO). While working on DX being promoted by Chief Digital Officer (CDO), the task forces are ushering in transformation with the two business divisions and Corporate Division as one team. We will now strive to increase ROIC as a KPI of the MTP across the entire Group, achieve organizational management reform to improve employee engagement, and transform our corporate culture.

Implementation structure for corporate culture transformation

Implementing multi-stakeholder management inclusive of future generations

I re-read Davos Manifesto 1973 during the stay-at-home period, and I found many words of wisdom that now echo in me. The Manifesto states the responsibilities of management include “it must assume the role of a trustee of the material universe for future generations,” “it has to use the immaterial and material resources at its disposal in an optimal way,” and “it has to continuously expand the frontiers of knowledge in management and technology.” I found these words very enlightening; therefore, I would like to share them with you today. They embody the essence of a multi-stakeholder philosophy and represent the ASV that the Ajinomoto Group strives for.

Under the banner of “a solution-providing group of companies for food and health issues,” the Ajinomoto Group is committed to providing solutions through its strengths even under the challenges posed by the COVID-19 pandemic. We aim to balance long-term and sustainable management policies and prompt management reform, while enhancing our corporate value encompassing market cap (shareholder value), corporate brand value (customer value), and employee engagement (human resource value). Toward this end, we look forward to your continued support.

August 2020

Takaaki Nishii

Representative Director,

President & Chief Executive Officer